Client

Indian Bank

Industry

Banking & Finance

Services

User Research

UI Design

Timeline

6+ Months

Tools

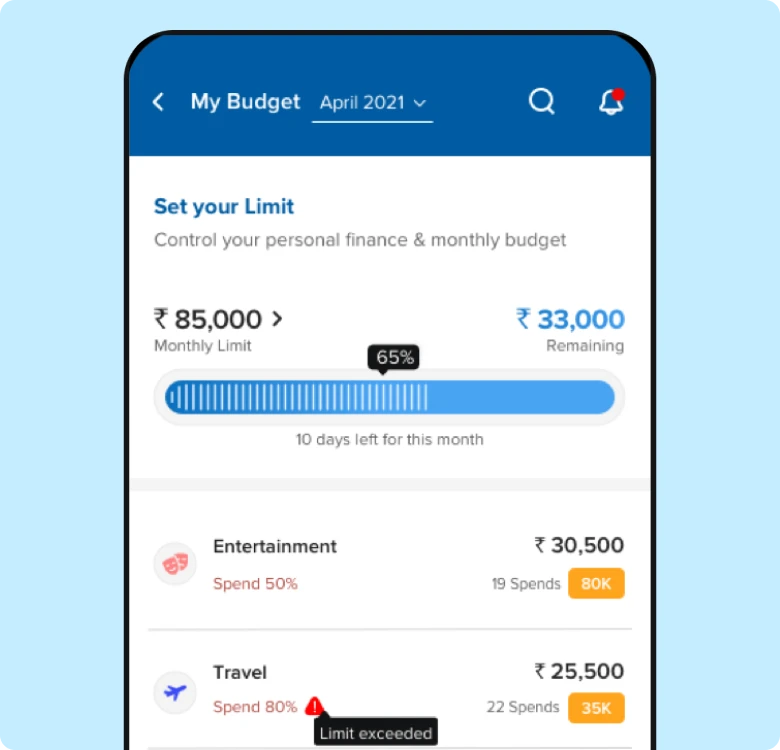

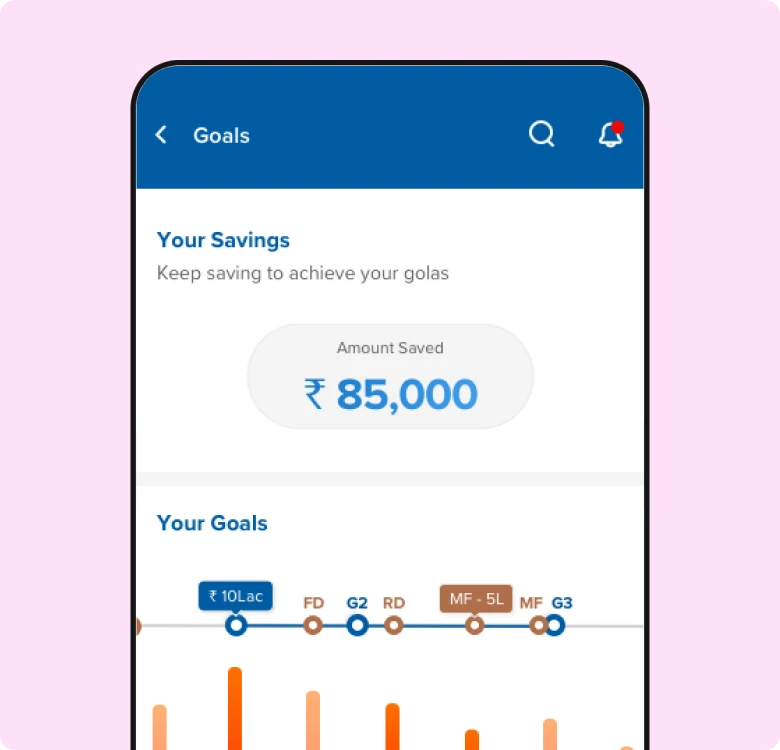

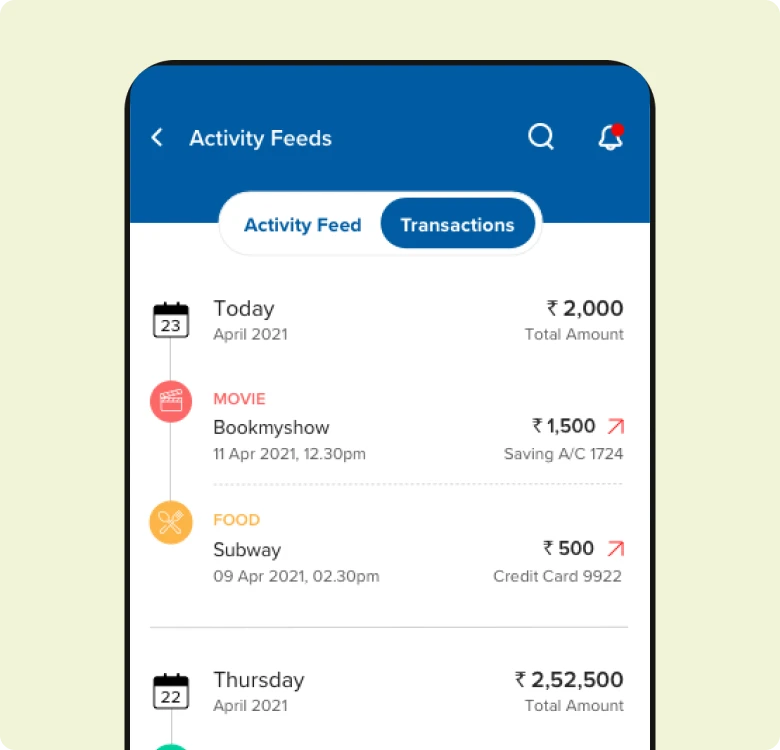

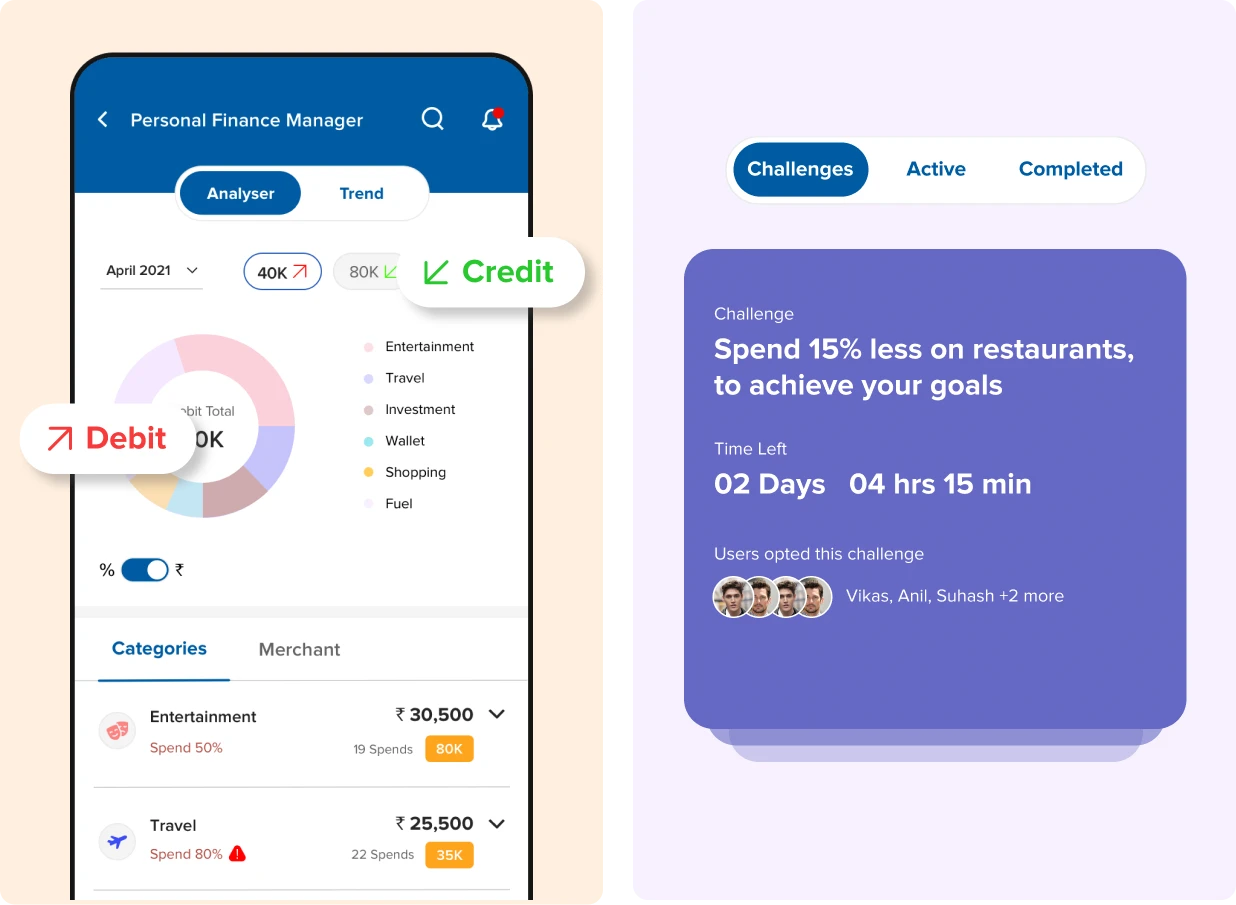

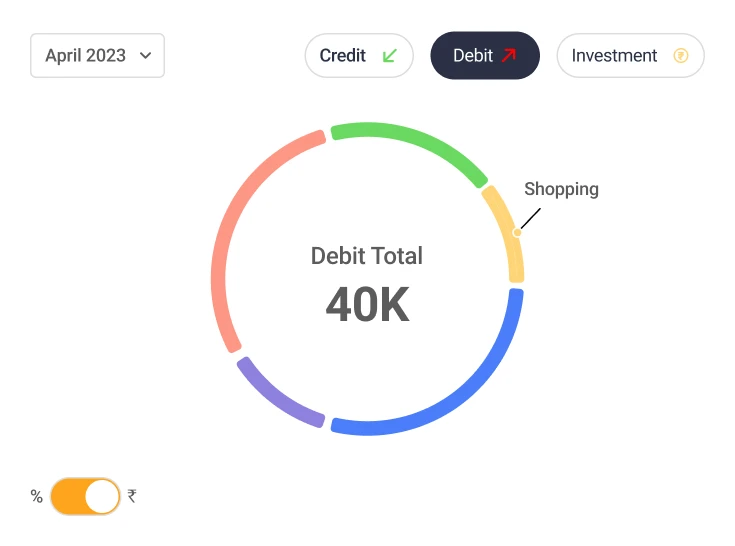

helps you understand your spending habits by breaking down your expenses into clear categories, identifying trends, and highlighting areas where you might be overspending.

helps you understand your spending habits by breaking down your expenses into clear categories, identifying trends, and highlighting areas where you might be overspending.